UnitedCrowd

UnitedCrowd

platform to attract investment in new -projects

introduction

As we all know that the emergence of blockchain technology has changed the world faster and stronger, with almost every industry in the world implementing the most advanced technology, the financial industry is among them. The emergence of blockchain has connected the financial industry in a more seamless and modern way, on the one hand Cryptocurrency has grown significantly in recent years. These developments make cryptocurrency better and can be applied to more complex financial cases. especially with the UnitedCrowd project that will turn the Cryptoqurrency world into a beautiful one, this project will bring huge profits to its users and investors.

What is UnitedCrowd?

UnitedCrowd Is a platform for attracting investment in new projects, will help you understand this difficult problem. Here you will find many opportunities to grow your project and attract initial investment for further development. In addition, UnitedCrowd is an official platform registered in Germany, so you don't need to worry about wasting time using this service, and here you will get maximum security when transacting. UnitedCrowd only works with qualified and trusted investors and will help you find the right investors, in fact, taking all the work to fund your project.

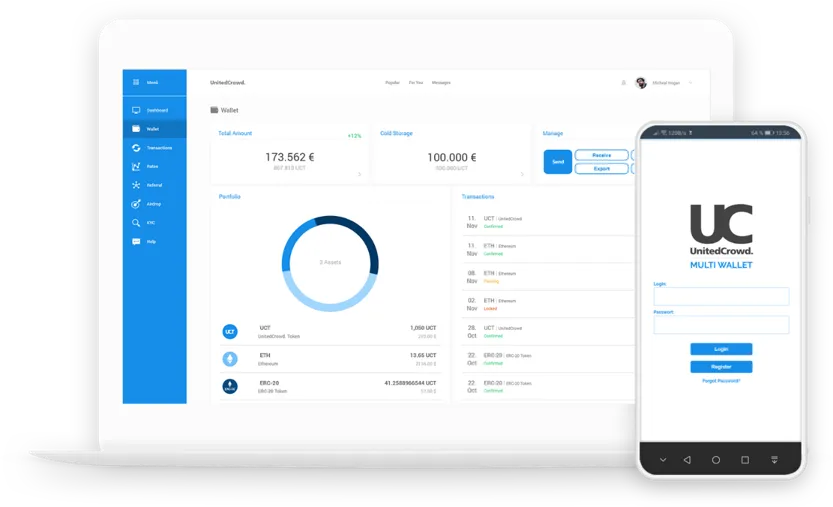

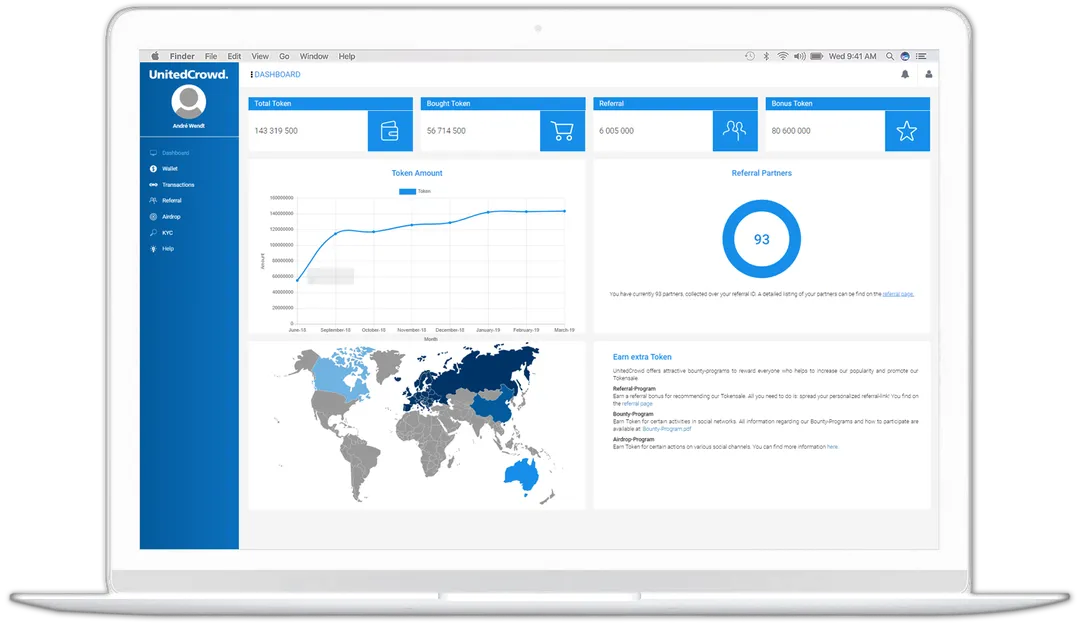

On the UnitedCrowd platform, you can also oversee the fundraising process for your project around the clock. A very comfortable and intuitive software application interface will be able to support inexperienced users. The design will not make you difficult because it is very accessible. And also Individual layout means that you will be helped to develop an interface layout according to your parameters and needs. UnitedCrowd already operates on the blockchain network and therefore fundamentally protects your data. All material related to your project will be available for potential investors to view via the platform. like the example image below.

There are different types of tokens

- Asset Token

Liquid such as illiquid characteristics can be arranged as an Asset Token. The range consolidates everything from cash, land, essential metals or craft objects to hypothetical assets, for example, licenses or copyrights.

- Payable Token

The Commitment Token handles commitment claims for the repayment of all contributions with or without interest. This range combines the types of protection, advancement and protection.

-

Ownership of Equity Token Shares and projecting voting rights can be overcome with Equity Tokens. Using comparative rules, tokens can similarly handle the interior of a resource, for example.

- Utility Tokens

Address token utilities exercise rights and can offer induction to associations, products or organizations.

Why is UnitedCrowd interesting?

- Level of Financing

We offer our clients and their monetary experts a uniquely designed theoretical backend.

- Legal framework

We work under German law to offer you and your monetary experts the best security.

- Partner associations

Get induction into our association from outside theorists and trained professionals.

- Investor society

Get progress and responsibility from the UnitedCrowd community.

Issuance of tokens

Compliance with the legal framework and regulatory mechanisms is guaranteed both off-chain and on-chain.

1. Review of the publisher

Before UnitedCrowd created digital financial products, we checked publishers against questionable and evaluated fixed parameters. This includes, for example, due diligence, corporate governance and security, but also management, which, among other things, goes through standard checks and background checks on integrity and reputation risks.

2. Choice of financing type

If the requirements are met and we are confident in the sustainability of the project, the decision on the type of financing follows the second step. With the Tokenization Framework, different values can be digitized with all the rights and obligations contained therein. Depending on the requirements and objectives of the company, these variants have different suitability.

Thus the following classifications become relevant:

● Asset Token (financial asset)

Both liquid and illiquid assets can be represented as securities that are tokenized by Asset Tokens. In this way, they can be converted into digital and proportional fractional ownership (partnerships) and can be accessed by international markets. The spectrum includes everything from cash, cash equivalents, savings accounts, real estate, precious metals or art objects to intangible assets such as patents, copyrights or trademark rights.

● Token equity (stock)

Equity tokens can represent shares in a company and voting rights, as well as shares in funds.

● Debt Token (the right to claim)

The token represents a debt claim for repayment of the amount invested with or without interest. The range includes bonds, loans and bonds.

● Utility tokens (service and usage rights)

Utility tokens represent usage rights and can be used, for example, to provide access to the network as a community token or to receive goods or services offered by the token issuer.

Issuance of tokens

Compliance with the legislative system and administrative framework is guaranteed both off-line and on-line.

Publisher review: Before UnitedCrowd produced a digital financial offering, they reviewed publishers against fixed conditions that were being questioned and assessed. This involves, for example, due diligence, corporate governance, and safeguards, but also administration, which, among other things, undergoes standard checks and background checks on damages to honesty and credibility.

Choice of financing method: if the requirements are met and they are convinced of the feasibility of the proposal, a decision on the type of financing will be made in the second stage. In the Tokenization Framework, all the privileges and responsibilities found therein can be digitized in various values. Based on the specifications and objectives of the organization, this version has varying suitability.

Emissions and permits: Now that all contract conditions have been explicitly defined, tokens can be released. Tokens should consider authorization to purchase either via an off-chain verifier or through the associated KYC / AML requirements at the smart contract level. It can also be sent only to whitelisted or authenticated received addresses that are linked to the individual. Although currently approved users may not need to be approved, tokens should consider investor certification for new users.

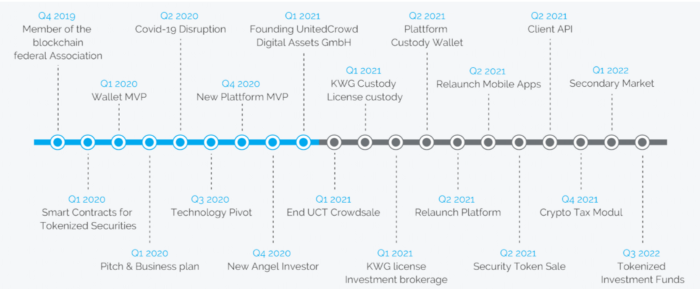

Roadmap

Tim.

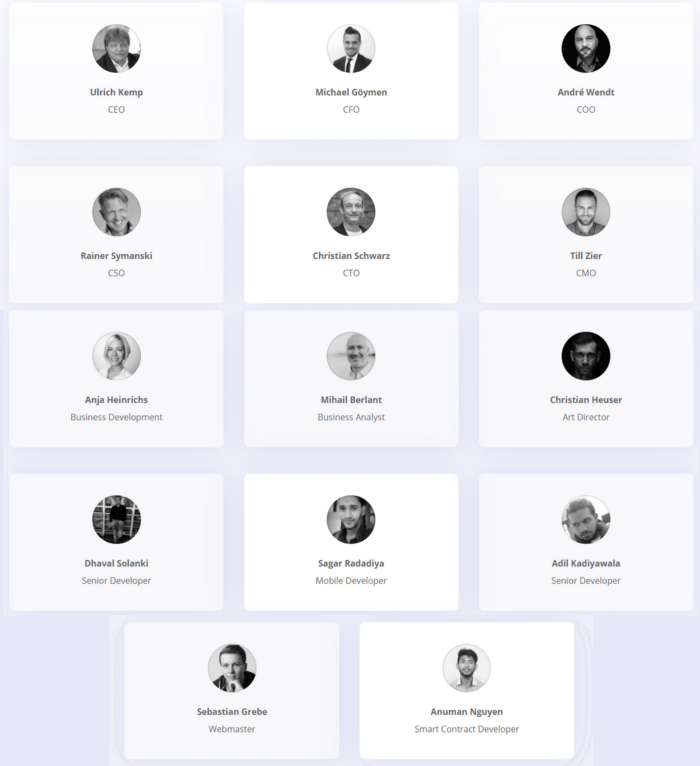

UnitedCrowd project partner

Further information:

● Website: https://unitedcrowd.com/

● Facebook: https://www.facebook.com/UnitedCrowd/

● Twitter: https://twitter.com/unitedcrowd_com

● Telegram: https://t.me/UnitedCrowd

● Linkedin: https://www.linkedin.com/company/unitedcrowd/

● Instagram: https://www.instagram.com/unitedcrowd_com/

● Youtube: https://www.youtube.com/c/UnitedCrowd

● Media: https://medium.com/@unitedcrowd

Username chrisana Link: https://bitcointalk.org/index.php?action=profile;u=2633297

Komentar

Posting Komentar